Andre Hakkak's Net Worth stands as testament to his expertise, strategic vision, and significant contributions to the finance industry. As co-founder and CEO of White Oak Global Advisors he has established himself as a key figure within this sector.

Hakkak's wealth is closely connected with the performance of his primary company, which provides credit financing solutions to businesses. Additionally, his diversified portfolio contains investments in real estate and tech startups.

Real estate

Andre Hakkak has amassed an immense fortune through careful investment decisions and clever strategies, amassing multimillionaire status with various real estate properties and investments across various companies. Hakkak serves as CEO of White Oak Global Advisors - an investment service company with assets totaling more than $10 billion that offers equity financing, venture capital investments and fixed income options - offering him multiple revenue streams from investors as a result of his wise decisions and strategies.

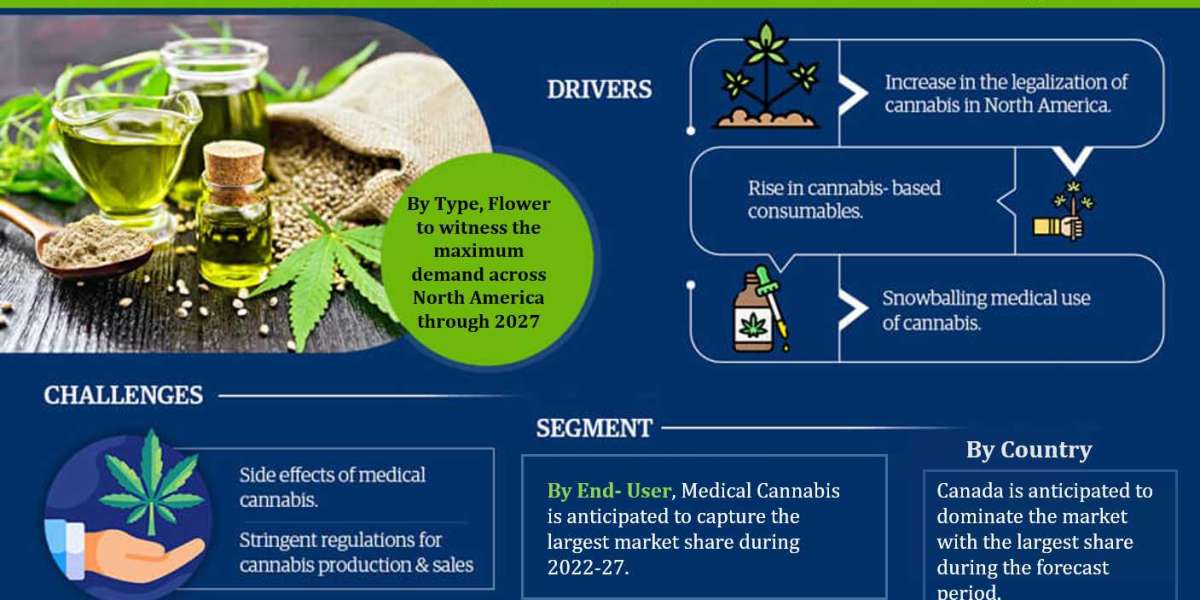

Hakkak is also an active investor in technology and real estate, possessing an in-depth knowledge of market trends and lucrative investment opportunities, which has propelled him into one of the leading figures of finance industry. Furthermore, in addition to his business acumen and charitable giving activities, he is known as an avid philanthropist whose charitable endeavors he supports regularly.

Hakkak's estimated net worth ranges between $200 million and $10 billion. He earned much of his wealth as an entrepreneur, investor banker, opinion columnist, business consultant, opinion columnist, opinion columnist and co-founder of White Oak Global Advisors LLC which manages assets for clients - the largest alternative asset management firm in the US which also contributed substantially to Hakkak's net worth.

Investments

Andre Hakkak has come a long way from his humble origins to build an impressive net worth. Through smart business decisions and strategic thinking, his expertise in alternative asset management has catapulted him to prominence within finance industry - earning him wide respect. Today, Andre serves as co-founder and CEO of White Oak Global Advisors which offers middle market businesses credit financing solutions.

His investment portfolio spans real estate, tech startups and other business ventures. Additionally, he holds substantial assets in alternative asset investments and sits on several boards such as Alpine Global Investment LLC and Suisse Global Management LLC. His vast experience in finance gives him unparalleled insights into market trends and opportunities.

He is an attentive family man and takes immense pleasure in his work. Since 2015, he and Marissa Shipman have been happily married, producing two children between them. Together, the couple resides in Coral Gables, Florida where they own an extravagant property worth $13.6 million.

His success is the result of hard work and ambition. Through sheer determination and perseverance, he has achieved remarkable milestones in his professional life. Additionally, his astute investment decisions and deep market understanding enable him to navigate the complexities of financial landscape and make successful business investments.

Philanthropy

Andre Hakkak's success in finance does not limit his dedication to philanthropy; in fact, his wealth comes with the responsibility to create positive change within society. Through donations to organizations providing education and healthcare for those most in need.

His philanthropic efforts have greatly assisted in the growth and development of communities. Additionally, he holds great regard for cultural preservation; further believing that education is the cornerstone of creating a prosperous future for humanity.

Hakkak's charitable endeavors have left an indelible mark, earning him great respect within business circles. He has invested in several educational initiatives - including scholarship programs that allow students to pursue their passions - as well as initiatives that make high-quality education more readily available and inclusive of people of diverse backgrounds.

Hakkak leads an understated life despite his remarkable success, maintaining a modest lifestyle and remaining relatively obscure in public. With an emphasis on confidentiality and privacy that has seen him achieve great success in the financial industry. In his free time he enjoys golfing, wine tasting and cheering for Golden State Warriors NBA team while reading history/cultural books as well as southern contemporary art books - his unique approach to entrepreneurship/philanthropy stands him apart from his peers, garnering widespread recognition within financial industry circles.

Personal life

Andre Hakkak is an integral figure in the financial industry, and his accomplishments speak volumes about his strategic acumen and investment acumen. Through White Oak Global Advisors he has left an indelible mark that will only continue to flourish with time - his philanthropic efforts also contribute to his wealth and influence.

His career started out in the early 1990s when he began as an investment banker at Robertson Stephens and Co. These experiences gave him a firm grounding for future success, which he utilized throughout his life. Later he co-founded Suisse Global Investments as an alternative asset management firm; their successful operations contributed significantly to his net worth.

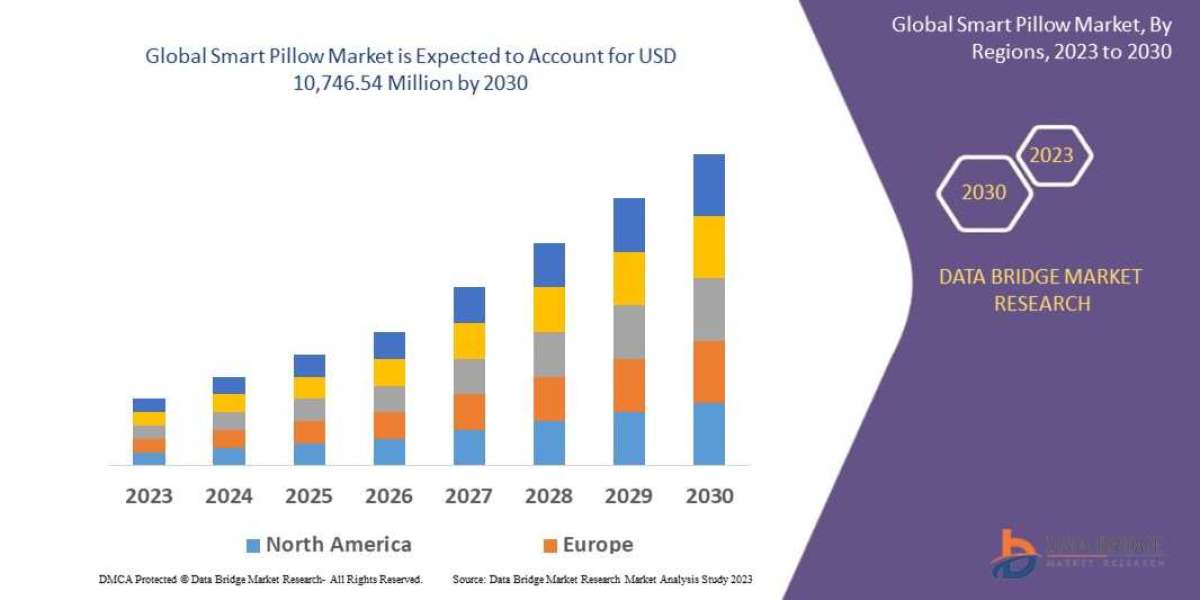

Hakkak's assets and investments are estimated to top $10 billion by 2024. This estimate accounts for White Oak Global Advisors's continued expansion as well as personal investments held by Hakkak and current market conditions.

His diverse investment portfolio has generated significant returns, while his strategies have allowed him to expand into new sectors. He specializes in investing in tech companies and his success can be attributed to spotting lucrative investment opportunities. Furthermore, he leads an extravagant lifestyle, spending much of his money on luxury items like expensive watches and brand-new cars.