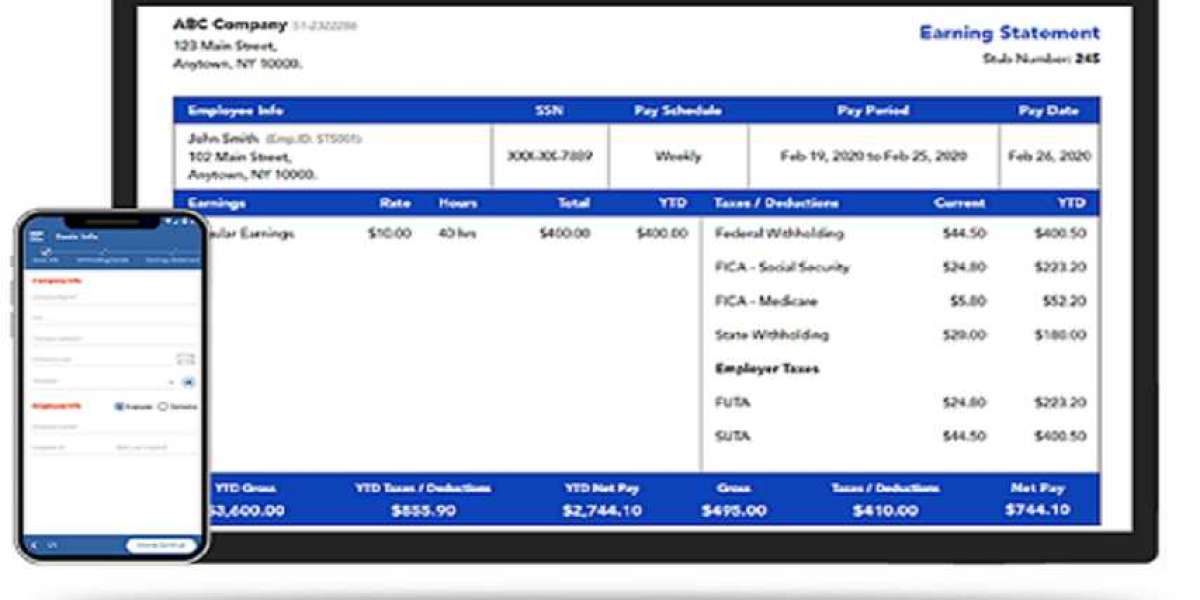

Paystubs are vital documents in the world of employment, providing detailed insights into your earnings, deductions, and overall financial status. Whether you receive your paystub electronically or on paper, understanding how to read and interpret it correctly is crucial for managing your finances and ensuring accuracy in your payroll records. This comprehensive guide will walk you through the essential components of a paystub and how to use a free paystub generator to create accurate paystubs for your needs.

What is a Paystub?

A paystub, also known as a paycheck stub, is a document that accompanies your paycheck and provides a detailed breakdown of your earnings and deductions for a specific pay period. It serves as a record of your income and can be used for various purposes, including tax filing, loan applications, and verifying your income.

Key Components of a Paystub

Understanding each component of a paystub is essential for accurate financial management. Here are the primary sections you’ll find on most paystubs:

Employee Information

This section includes your personal details and information about your employer:

- Employee Name: Your full name as it appears in the company records.

- Employee ID: A unique identifier assigned by your employer.

- Employer Name: The name of the company or organization.

- Employer Address: The address where the employer is located.

Pay Period

The pay period indicates the time frame for which you are being paid:

- Pay Period Start and End Dates: The beginning and ending dates of the pay period.

- Pay Date: The date on which your paycheck is issued.

Earnings

This section details the various types of earnings you receive:

- Gross Pay: The total amount earned before any deductions. This includes your base salary or hourly wage, overtime, bonuses, and any other forms of compensation.

- Regular Hours: The number of standard hours worked during the pay period.

- Overtime Hours: Hours worked beyond the regular schedule that qualify for overtime pay.

Deductions

Deductions are amounts subtracted from your gross pay:

- Federal Taxes: The amount withheld for federal income tax.

- State Taxes: The amount withheld for state income tax (if applicable).

- Social Security and Medicare: Contributions to Social Security and Medicare programs.

- Retirement Contributions: Amounts contributed to retirement accounts, such as a 401(k) or IRA.

- Health Insurance: Deductions for health insurance premiums.

- Other Deductions: Any additional deductions, such as union dues or garnishments.

Net Pay

The net pay is the amount you take home after all deductions are applied. It’s calculated as follows:

Net Pay=Gross Pay−Total Deductions\text{Net Pay} = \text{Gross Pay} - \text{Total Deductions}Net Pay=Gross Pay−Total Deductions

Year-to-Date (YTD) Information

YTD information summarizes your earnings and deductions for the entire year up to the current pay period:

- YTD Gross Pay: Total gross earnings for the year.

- YTD Deductions: Total deductions for the year.

- YTD Net Pay: Total net pay received for the year.

Using a Free Paystub Generator

A free paystub generator can simplify the process of creating and managing paystubs. Here’s how to use one effectively:

Choosing the Right Tool

When selecting a free paystub generator, consider the following factors:

- Ease of Use: The tool should be user-friendly and easy to navigate.

- Customization Options: Look for options to customize the paystub template according to your needs, such as adding specific deductions or additional earning types.

- Accuracy: Ensure the generator accurately calculates earnings, deductions, and taxes based on current rates and regulations.

Inputting Information

To generate a paystub, you’ll need to input the following information:

- Employee Details: Name, ID, and address.

- Employer Details: Name and address.

- Pay Period Information: Start and end dates of the pay period, and the pay date.

- Earnings Information: Regular hours, overtime hours, bonuses, and other forms of compensation.

- Deductions Information: Federal and state taxes, Social Security, Medicare, retirement contributions, and other deductions.

Generating and Reviewing the Paystub

After entering the necessary information, generate the paystub and review it carefully:

- Verify Accuracy: Check all details to ensure accuracy. Ensure that earnings and deductions match your records.

- Save and Print: Save a digital copy of the paystub and print it if needed. Ensure that you have backups for future reference.

Updating and Revisions

If there are changes in your earnings, deductions, or tax rates, update the paystub accordingly. Regularly review and revise paystubs to ensure they reflect the most current information.

Common Mistakes to Avoid

When using a free paystub generator, avoid these common mistakes to ensure accuracy and compliance:

Inaccurate Data Entry

Entering incorrect information can lead to inaccuracies in your paystub. Double-check all details before generating the paystub.

Missing Deductions

Ensure that all applicable deductions are included in the paystub. Missing deductions can lead to incorrect net pay calculations and potential compliance issues.

Outdated Tax Rates

Free paystub generators may not always reflect the most current tax rates or regulations. Verify that the tool is updated with the latest tax information or consult a professional if needed.

Incomplete Paystubs

Ensure that all required sections are included in the paystub. An incomplete paystub can lead to confusion and potential issues with verification or compliance.

Failure to Review

Always review the generated paystub for accuracy before finalizing it. Mistakes can be costly and time-consuming to correct later.

The Importance of Accurate Paystub Information

Accurate paystub information is crucial for several reasons:

Tax Filing

Paystubs provide essential information for tax filing, including total earnings and deductions. Accurate paystubs ensure that you report your income correctly and avoid potential issues with tax authorities.

Loan and Rental Applications

Paystubs serve as proof of income for loan and rental applications. Accurate and complete paystubs can help you secure loans or rental agreements by providing reliable financial information.

Financial Planning

Understanding your paystub helps you manage your finances effectively. By reviewing your earnings, deductions, and net pay, you can make informed decisions about budgeting, saving, and investing.

Legal Compliance

Accurate paystubs are essential for complying with labor laws and regulations. Proper record-keeping and accurate paystubs help you avoid legal issues and ensure compliance with employment standards.

Conclusion

Understanding your paystub is essential for managing your finances, ensuring compliance, and making informed financial decisions. By familiarizing yourself with the key components of a paystub and using a free paystub generator effectively, you can create accurate and reliable paystubs for your needs. Avoid common mistakes, review your paystubs regularly, and consult with professionals when needed to ensure accuracy and compliance. With proper understanding and management, paystubs can serve as valuable tools for financial planning and record-keeping.