Starting a new car rental business requires a substantial upfront capital investment. Between purchasing a fleet of vehicles, equipment, renting or building office/counter space, marketing costs, and other startup expenses - the initial budget can easily exceed $500,000. While car rental is a lucrative business with high profit margins, that large of an investment poses problems for new entrepreneurs with limited capital.

However, there are many strategic ways to significantly reduce the costs of launching a rental operation. With proper planning and creativity, a new rental company can get started for far less than typical startup estimates. This article will explore eleven key areas where costs can be cut, allowing entrepreneurs to launch their dream business with a more manageable initial investment.

Buy Used Vehicles Instead of New

Perhaps the biggest single expense for any rental company is acquiring its initial fleet of cars. New vehicles are an attractive option but come at a high price tag - often double or more the cost of a high-quality used vehicle. Late-model used cars 1-3 years old can reduce fleet costs by 25-40% compared to buying new.

While used cars lack the appeal of a completely new vehicle, focusing the fleet on 1-3 year old cars with under 50,000 miles still provides customers quality vehicles with most of their depreciation already taken. Late model used cars generally have many years of life left in them and still come with factory warranties to keep maintenance predictable. They also present far less financial risk than older used cars that may require unexpected repairs down the road.

When assembling the initial fleet, stick to one or two commonly available vehicle models from the most recent two model years to simplify maintenance and parts inventory. Negotiate directly with dealerships and consider off-lease fleet vehicles that dealers are highly motivated to move. With an upfront order of 10-15 vehicles as a new rental company, you have leverage to negotiate aggressive prices well below retail.

Negotiate Discounts with Dealerships

While purchasing used cars directly from dealers can save versus retail prices, fleet discounts provide even steeper savings potential. New rental companies should negotiate directly with multiple dealerships of the desired makes and models to obtain competing written quotes. This allows using the best offer as leverage against the others to try and pull quotes lower. Being a new rental fleet customer trying to build business also makes dealers more amenable to negotiating.

In addition to haggling over vehicle prices, request add-on perks like free scheduled maintenance for the first year or two, oil changes, car washes, bonded vehicle shop personnel rates, and other services. Bonus items that keep operating costs lower over the lifetime of the vehicle help offset a slightly higher acquisition cost. Dealers are also incentivized to provide discounts on additional vehicles in future fleet orders. With the right negotiation, it's possible to achieve prices 10-15% below standard fleet rates.

Procure Fleet Financing

Just as consumers can get better loan terms than retail through banks, entrepreneurs should apply for fleet financing programs specially designed for rental car companies. Major fleet lenders like Dell Financial Services, PNC Equipment Finance, and Sovereign Fleet Financing specialize in providing loans, leases, and reservations financing specifically to car rental businesses.

These lenders understand the model and revenue cycle of car rentals better than a traditional bank. This allows them to customize financial products with structures and terms optimized for rental fleet growth. Interest rates on fleet loans are routinely 1-2 percentage points lower than average retail auto loans, saving thousands in finance charges over the loan term. Fleet loans from equipment finance companies should be the first avenue explored before considering bank loans or lines of credit.

Additionally look for programs that provide dealership referrals incentives, where the lender cuts a check to the dealership for new business they bring in. This “bounty” helps discount the vehicle price upfront and makes the proposal more attractive to the dealer. Visit: https://zipprr.com/car-rental-script/

Utilize Rental Car Consortia Membership

Big rental brands like Enterprise, Hertz and Avis use their sheer size to negotiate directly with vehicle manufacturers for massive fleet discounts. But startup rental companies should check if membership is available in any rental consortiums or buying groups. These industry organizations negotiate discounted rates on behalf of independent/franchise operators in exchange for annual consortia dues.

Groups like the Rental CarFinance Corp and National Car Rental offer independent members fleet purchase prices on par with major brands. Members also gain other benefits like reservation and counter access at other locations nationally, centralized insurance and fleet financing programs, group buying discounts on supplies/accessories, and shared best practices. The dues spend is easily offset by the discounted vehicle and ongoing operational savings realize through membership.

Consortia can be a powerful strategy for startups to get fleet volumes and pricing clout on day one that would otherwise take years individually. Make inquiring about joining a buying group among the first steps in planning the fleet acquisition budget.

Rent Space at Existing Rental Locations

Rather than renting an expensive standalone commercial space solely for your new rental business, consider partnering with existing rental agencies. Approach local rental counters about renting a desk, kiosk or small office area within their location. This provides a ready-made rental counter environment without needing to furnish one yourself upfront.

Sharing amenities like parking lots, waiting areas, signage, rental agreements paperwork, and the established brand recognition of the host agency significantly reduces startup costs. Typical licensing deals involve paying a monthly desk fee and revenue share percentage on bookings from your customers. It allows launching rental operations immediately while developing business before committing to building out your own dedicated space.

If successful, the off-site location remains a satellite counter even once standalone spaces open later. Use initial rent-a-desk partnerships as a low commitment way to evaluate market opportunity before investing heavily in permanent facilities.

Defer Rental Payments on New Vehicles

When placing large vehicle orders with dealerships or manufacturers, negotiating payment terms is crucial. Rather than standard terms of paying invoice price upon delivery, request a 90-day deferral of the first vehicle payment. Having an extra 3 months of cash flow flexibility gives breathing room for the new business to get rental operations generating income before debt service begins.

Be fully transparent about the need for deferred payment to help launch your small, startup company. Larger initial orders increase your leverage for accommodating payment structures. Manufacturers want to see their brands represented in new independent rental fleets and may accommodate requests from sincere entrepreneurs. At minimum, dealerships should be open to negotiating if it means securing the large order volume. Even a small deferral period can make or break some tight startup budgets.

Use Rental Software Instead of Custom Development

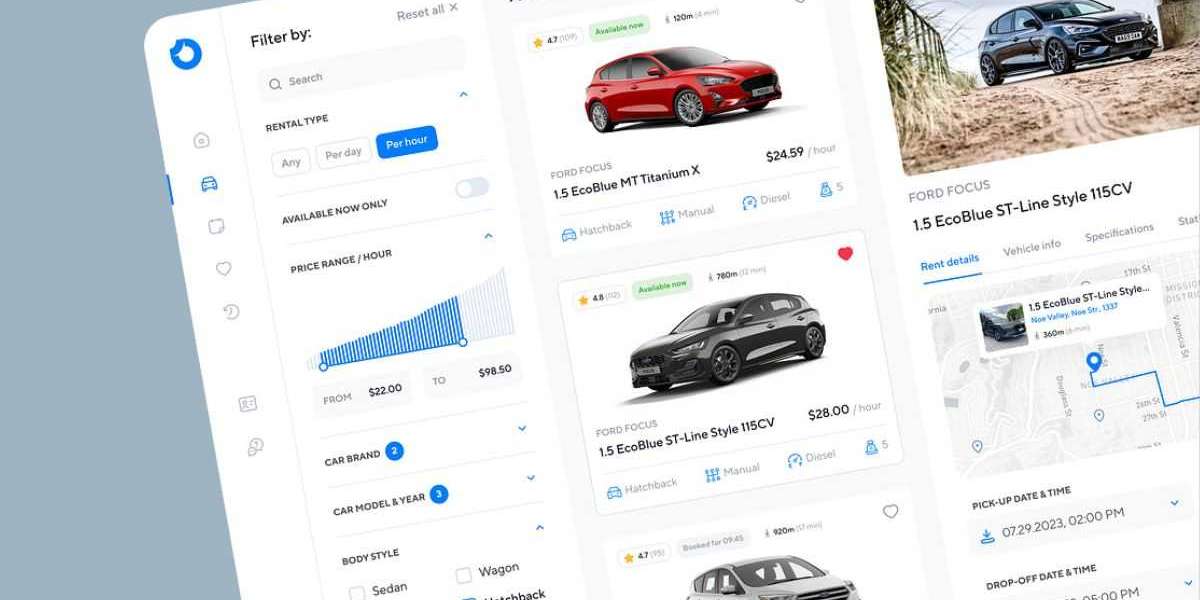

Rather than investing tens of thousands into developing proprietary booking or fleet management software, consider off-the-shelf rental software programs. Providers like Fleetlogic, AutoManager and Rentman offer monthly or annual subscription rental software packages for a fraction of custom development costs.

This spreads the initial expense over time and provides functionality out of the box that would take significant in-house dev work to replicate. Most rental software integrates reservation platforms, inventory/fleet management, CRM systems, accounting, and analytics - saving ongoing payroll versus hiring software engineers and IT staff.

Look for solutions that integrate bookings across online/mobile channels and provide open APIs for future additions. Many allow customizing the site/app look and adding co-branded mobile apps. The operational efficiencies gained from streamlined software far outweigh any marginal cost savings of building a system in-house from scratch as a startup.

Sign Up for Reward Programs

Taking advantage of loyalty reward programs is a simple way for rental companies to get cash back on qualifying operating expenses. Enroll business fuel cards in programs like Fuel Rewards and start earning points on gas purchases. Programs like Avis Preferred allow earning points on rental bookings that can be exchanged for free rental days.

Manufacturers also offer fleet loyalty programs where purchasing a certain number of new vehicles earns membership applying points earned back as service credits or cash rebates. Redeem accumulated points for supplies, equipment, services and other items to subsidize costs. Some programs even allow cashing points out for hard dollar amounts off invoices. Taking a few minutes to sign up pays ongoing dividends that compound over time.

Apply for Small Business Grants/Loans

While starting lean is important, grants and loan assistance can help inject welcome capital that doesn't need to be paid back. Research available small business grants offered through local economic development agencies, chambers of commerce or state/regional programs looking to foster new business startups.

Applying involves some paperwork but grants are essentially free money that doesn't burden new companies with debt or interest charges. The US Small Business Administration also offers a variety of loan guaranty programs through participating banks. These SBA loans tend to have reasonable rates and terms ideally suited to small business launches with borrowing capacity based on personal and business financial profiles.

Consulting local Small Business Development Centers for guidance navigating available funding programs extends budgets further at arguably the most crucial phase. Any subsidies received augment operational cash flow and investment potential.

Use Freightliner or Commercial Grade Vehicles

While trendy crossover SUVs and upscale sedans are alluring for rental fleets, consider converting portions of the fleet to freightliner-class or other heavy-duty commercial vehicles for cost savings.

While trendy crossover SUVs and upscale sedans are alluring for rental fleets, consider converting portions of the fleet to freightliner-class or other heavy-duty commercial vehicles for cost savings. Vans like the Freightliner Sprinter are purpose-built for commercial applications and designed with an emphasis on durability, reliability and lower operating expenses over the life of the vehicle.

Freightliners and commercial-grade vehicles built on truck platforms can achieve 25-40% better fuel efficiency than personal-use models carrying comparable passenger loads. Maintenance intervals are often extended compared to cars with less wear-and-tear parts. Heavier chassis absorb road impacts better, resulting in longer component longevity and reduced repair bills over time.

Commercial insurance rates also apply which are usually 20-30% cheaper per vehicle versus standard coverage. And resale values hold up well since these vans don't rapidly depreciate out of commercial service like personal vehicles after a few years.

While not ideal for all customers, dedicating 10-25% of the rental fleet to bulletproof commercial vans brings in new customer segments like contractors while slashing per-mile costs. It pencils out as a smart diversification alongside standard cars and crossovers.

Consider Used Rental Equipment

When furnishing a rental counter, kiosk area or waiting lounge, consider the used market for supplies rather than everything being new. Websites like Craigslist and used commercial equipment dealers often list barely used rental counters, kiosks, furniture and décor from expanding companies upgrade cycles at deep discounts.

As long as items meet basic standards of functionality, condition and appearance standards, it's an easy way to outfit new locations for pennies on the dollar versus shiny new models. Negotiating with rental and leasing firms directly about takeback furniture from closing branches or locations undergoing remodels unearths incredible bargains.

Be choosy and pass on anything worn, but with some remodeling most lightly used items are indistinguishable from new. This protects startup budgets while creating a polished, professional customer environment on par with national brands spending top dollar. Monitor classifieds in nearby major metro areas for regular opportunities on rental equipment turnover.

Conclusion

Starting a new car rental business undoubtedly requires substantial investment. However, this article outlined eleven practical ways for entrepreneurs to potentially reduce costs by 30-50% or more from standard new business budgets through strategic planning and creativity.

Many of the techniques like used vehicle purchasing, aggressive dealer negotiation, consortia membership, off-site partnering and grant applications actually increase buying power and access to resources typically unavailable to small operators just starting out.

With the right cost-saving measures in each area tailored for minimum outlay, it's quite possible to launch a fully operational rental company offering quality vehicles and service for under $250,000 compared to usual multi-hundred-thousand dollar estimates. This makes the dream far more financially attainable.

For any entrepreneurs still determining feasibility or nailing down forecasts, exploring the full spectrum of best practices for keeping startup expenses low remain crucial homework. But with prudent planning guided by real-world techniques, new rental ventures can get up and running far leaner than conventional wisdom suggests.