In today’s fast-paced business world, small businesses need to ensure they are operating efficiently and responsibly. One of the often-overlooked aspects of running a small business is the importance of accurate paystubs. Whether you have a handful of employees or a growing team, understanding paystubs and their significance can help your business thrive.

What is a pay stub?

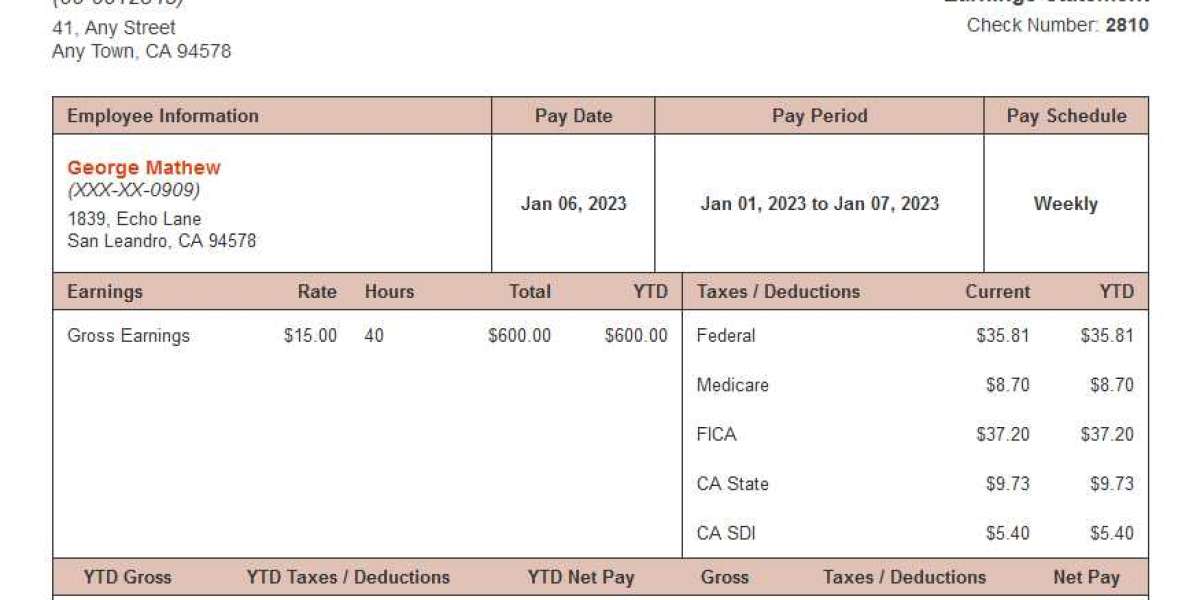

A pay stub, also known as a paycheck stub or wage statement, is a document provided by employers to their employees, detailing the amount earned during a specific pay period. It typically includes information such as:

- Gross Pay: The total earnings before any deductions.

- Deductions: Taxes, health insurance, retirement contributions, and any other withholdings.

- Net Pay: The amount the employee takes home after deductions.

- Hours Worked: For hourly employees, the number of hours worked during the pay period.

Accurate paystubs are not just a formality; they serve several important functions that can significantly impact your business.

Why Accurate Paystubs Matter

- Legal Compliance

In the United States, labour laws require employers to provide paystubs to employees. Accurate paystubs ensure compliance with federal, state, and local regulations. If a business fails to provide accurate pay information, it could face legal repercussions, including fines and lawsuits. Keeping your paystubs in order helps protect your business from potential legal issues.

- Employee Trust and Satisfaction

Employees appreciate transparency, and accurate paystubs foster trust. When employees receive clear and correct information about their earnings, they feel valued and respected. This trust leads to higher job satisfaction, which can reduce turnover rates. Happy employees are more productive and engaged, contributing positively to the overall workplace environment.

- Financial Planning for Employees

Paystubs play a crucial role in helping employees understand their financial situation. By detailing gross and net pay, as well as deductions, employees can make informed decisions about budgeting and savings. If employees are unclear about their earnings or deductions, it may lead to financial stress, impacting their performance at work.

- Record Keeping

For small businesses, maintaining accurate records is essential for financial health. Paystubs provide a documented history of payroll expenses, which can be invaluable during tax season or audits. Accurate records help you track employee wages and the overall labour costs of your business. This information can also be beneficial for future financial planning.

- Tax Preparation

Accurate paystubs simplify tax preparation for both employees and employers. For employees, having a clear breakdown of earnings and withholdings can make filling out tax forms much easier. For employers, accurate payroll records ensure that taxes are withheld correctly, which can prevent issues with the IRS down the line.

- Loan Applications

When employees apply for loans, lenders often require proof of income. Accurate paystubs can serve as verification of employment and income, increasing the chances of loan approval. If your business provides accurate paystubs, you are helping your employees secure financing when they need it, fostering goodwill and loyalty.

Common Mistakes to Avoid

While creating paystubs may seem straightforward, there are common mistakes that can lead to inaccuracies. Here are a few pitfalls to watch out for:

Incorrect Deductions: Double-check all deductions, including federal and state taxes, social security, and benefits. Errors in these areas can cause significant issues for both the business and the employee.

Miscalculating Hours: For hourly employees, accurate timekeeping is essential. Ensure that hours worked are logged correctly to avoid overpaying or underpaying employees.

Not Updating Information: If an employee changes their tax withholding status, pay rates, or benefits, be sure to update this information promptly. Failing to do so can lead to confusion and mistrust.

Neglecting to Keep Records: Always keep a copy of each paystub generated. This practice not only helps with audits but also serves as a reference in case of disputes.

Using a Check Stubs Maker

In the digital age, many small businesses are turning to check stub makers to streamline the process of creating accurate paystubs. A check stub maker is an online tool that simplifies the creation of paystubs, ensuring that all necessary information is included and correctly calculated. Here are some benefits of using a check stub maker:

Ease of Use: Most check stub makers are user-friendly and require no advanced technical skills. This accessibility means that business owners can generate paystubs quickly and easily.

Customization Options: Many check stub makers offer customizable templates, allowing you to add your business logo, employee information, and any specific details relevant to your pay structure.

Accuracy: Automated calculations reduce the chances of human error, ensuring that deductions and net pay are accurate. This accuracy is crucial for maintaining compliance and employee satisfaction.

Time-Saving: Generating paystubs manually can be time-consuming, especially if you have multiple employees. A check stub maker can speed up the process, allowing you to focus on other essential aspects of your business.

Digital Records: Most check stub makers allow you to store paystubs digitally, making it easier to access and retrieve records when needed. This digital approach also helps reduce paper waste.

How to Choose the Right Check Stubs Maker

When selecting a check stubs maker, consider the following factors:

Reputation: Look for a service with positive reviews and a good reputation. Research online to find user experiences and testimonials.

Features: Ensure the check stub maker offers all the features you need, such as customizable templates and automated calculations.

Pricing: Compare pricing among different check stub makers. Some may offer free basic versions, while others charge a fee for advanced features. Choose one that fits your budget.

Customer Support: Good customer support can be a lifesaver if you encounter issues. Look for a service that offers assistance via email, chat, or phone.

Security: Ensure that the check stub maker prioritizes data security, especially since you’ll be handling sensitive employee information.

Final Thoughts

Accurate paystubs are a critical component of running a small business. They ensure compliance with legal requirements, build trust with employees, and facilitate financial planning. By leveraging modern tools like check stubs makers, small business owners can streamline the payroll process and focus on what matters most—growing their business.

In conclusion, taking the time to understand and implement accurate paystubs can yield significant benefits for your small business. By prioritizing this essential aspect of payroll, you are investing in the well-being of your employees and the overall health of your business.