For part-time teachers, managing finances can sometimes feel overwhelming, especially when juggling multiple teaching assignments, freelance tutoring, or other side jobs. Whether you're teaching at a local community college, offering private lessons, or filling in for full-time educators, financial clarity is key. This is where paystub creators come into play.

In this blog, we'll explore how check stubs makers can help part-time teachers manage their income, keep track of their pay, and stay organized for tax season. We'll cover everything from what paystub creators are to how they work and why they are especially beneficial for part-time educators.

What is a Paystub Creator?

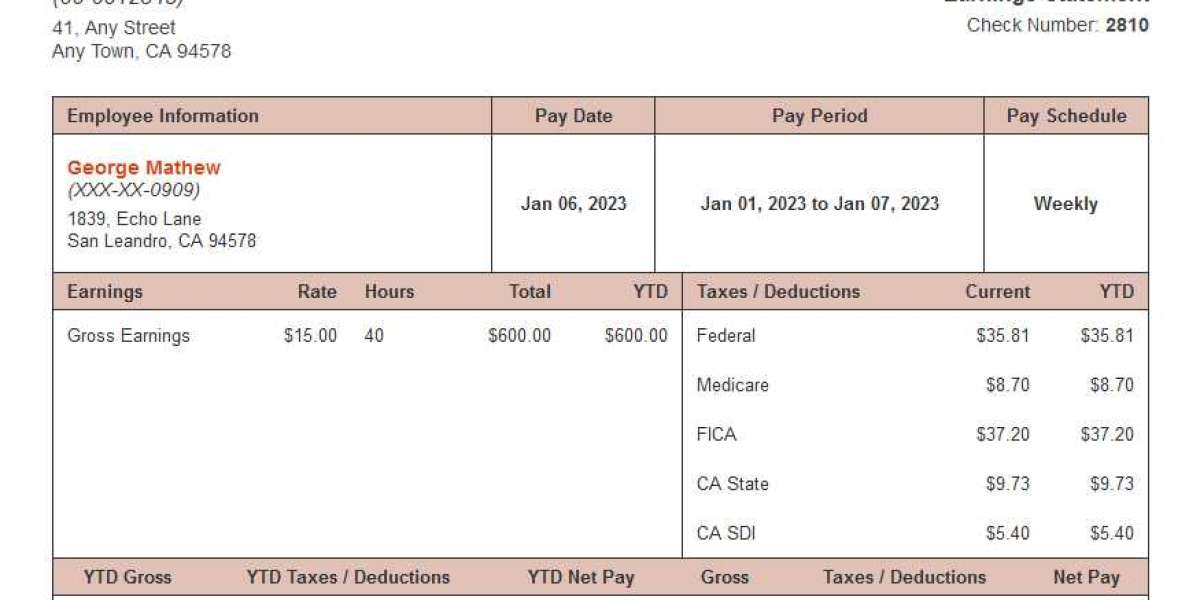

A paystub creator (also known as a check stubs maker) is an online tool that helps individuals or businesses generate paystubs or check stubs. These paystubs detail the income earned, deductions taken (such as taxes or benefits), and the net amount paid to the employee or freelancer. Paystub creators allow you to input key financial data to produce a professional-looking paystub.

For part-time teachers who might not have access to official payroll services, a paystub creator can be a simple, fast, and reliable solution to create accurate records of their earnings.

Why Do Part-Time Teachers Need Paystubs?

Many part-time teachers receive payments directly through checks, cash, or digital transfers like PayPal or bank transfers. While these payments are great, they often lack the detailed information needed for things like tax filing, budgeting, or even applying for a loan.

This is where having a paystub becomes important. Paystubs provide a breakdown of:

- Gross income: The total amount earned before deductions.

- Deductions: Taxes, insurance, or retirement contributions.

- Net income: The take-home pay after all deductions.

Here’s why it’s essential for part-time teachers to create and keep their paystubs:

1. Tax Reporting

As a part-time teacher, you are often responsible for reporting your own income, especially if you have multiple income streams. Unlike full-time employees, who may receive a W-2 from their employer, part-time and freelance teachers may not have the luxury of such documentation. Generating paystubs helps you maintain an accurate record of your earnings, making tax filing easier and reducing the chances of errors.

2. Proof of Income

If you're ever in a position where you need to show proof of income—such as applying for an apartment, a car loan, or a mortgage—having paystubs on hand is vital. Many lenders, landlords, and financial institutions require proof of consistent income before approving applications. If you don’t have paystubs, it can become difficult to prove your earnings.

3. Budgeting and Financial Planning

Keeping track of how much you’re earning from different teaching jobs or tutoring gigs can get confusing, especially if each job pays at different rates or times. Paystub creators allow you to have a clear view of your earnings and deductions, making it easier to budget effectively. Whether you're saving for a vacation, paying off student loans, or just managing monthly bills, having paystubs can provide clarity on your financial situation.

4. Tax Deductions for Part-Time Teachers

As a part-time teacher, you might be eligible for certain tax deductions—such as the educator expense deduction—if you spend money on classroom supplies or other teaching materials. Paystubs help you keep track of your income and expenses, which is crucial when calculating how much you can deduct from your taxes.

5. Side Hustles and Freelancing

Many part-time teachers don’t just rely on their teaching gigs; they also take up freelance work or side jobs. If you tutor students, offer workshops, or do any freelance educational work, a check stubs maker can help you track income from these side hustles. Even if the payments are irregular, creating a paystub ensures you have a reliable record of every payment you receive.

Benefits of Using Paystub Creators for Part-Time Teachers

Using a paystub creator is incredibly beneficial for part-time teachers for the following reasons:

1. User-Friendly and Accessible

Paystub creators are online tools, meaning you can access them from any device with an internet connection. Whether you’re at home or between classes, you can quickly generate a paystub without needing specialized software or hiring an accountant. Most paystub creators are intuitive and designed to be user-friendly, requiring only basic financial information to produce a detailed paystub.

2. Customizable

A check stubs maker allows you to customize your paystub to fit your unique situation. You can input your hourly rate, additional earnings from tutoring, bonuses, or other forms of income. You can also adjust deductions, such as taxes or healthcare contributions, to ensure that your paystub reflects an accurate picture of your finances.

3. Saves Time

Instead of spending hours manually creating pay records or calculating taxes, a paystub generator does it all for you in minutes. For part-time teachers who juggle multiple jobs, time is often in short supply. With a paystub creator, you can streamline the process and get back to what matters most—teaching!

4. Cost-Effective

Hiring an accountant or purchasing expensive payroll software can be unnecessary for part-time educators. A check stubs maker offers a more affordable option, often at a low cost or even for free, depending on the platform. This way, you can save money while still maintaining accurate financial records.

5. Professional Look

Having a professional-looking paystub can go a long way when dealing with banks, landlords, or potential employers. It shows that you are organized and responsible with your finances. A well-crafted paystub from a paystub creator looks just as professional as those issued by large corporations.

How to Use a Paystub Creator

Using a paystub creator is straightforward. Here’s a step-by-step guide:

Select a Paystub Creator Tool: There are many paystub creators available online. Look for one that is reputable, easy to use, and offers customization options.

Input Your Information: You will need to enter your personal details, such as your name and address. You’ll also input your job information, including employer details and hourly rate or salary.

Enter Earnings and Deductions: Add your total income for the period you’re creating the paystub for. You will also enter any deductions, such as federal and state taxes, Social Security, and Medicare, if applicable.

Generate and Download: Once you’ve input all the necessary data, the tool will generate a paystub for you to review. Make sure everything is accurate, then download and save the paystub for your records.

Print or Share: If needed, you can print the paystub to keep a physical copy or share it digitally with a landlord, lender, or accountant.

Choosing the Right Paystub Creator for Part-Time Teachers

When selecting a paystub creator, consider the following factors:

- Customization Options: Ensure the paystub creator allows you to input your specific details, like different pay rates or multiple jobs.

- Ease of Use: Look for an intuitive interface that makes creating a paystub quick and easy.

- Cost: Some paystub creators charge a fee, while others are free. Weigh the costs against the benefits of the tool.

- Accuracy: Make sure the paystub creator uses up-to-date tax information to calculate deductions properly.

- Security: Choose a paystub creator that protects your personal and financial information with encryption.

Conclusion

For part-time teachers, financial management doesn’t have to be a challenge. By using a paystub creator or check stubs maker, you can easily generate accurate records of your income, stay organized for tax season, and have proof of earnings whenever you need it. These tools are cost-effective, easy to use, and essential for maintaining financial clarity in the fast-paced world of education. Whether you’re balancing multiple teaching jobs or freelance gigs, a paystub creator can help you stay on top of your finances with minimal effort.