Summary:

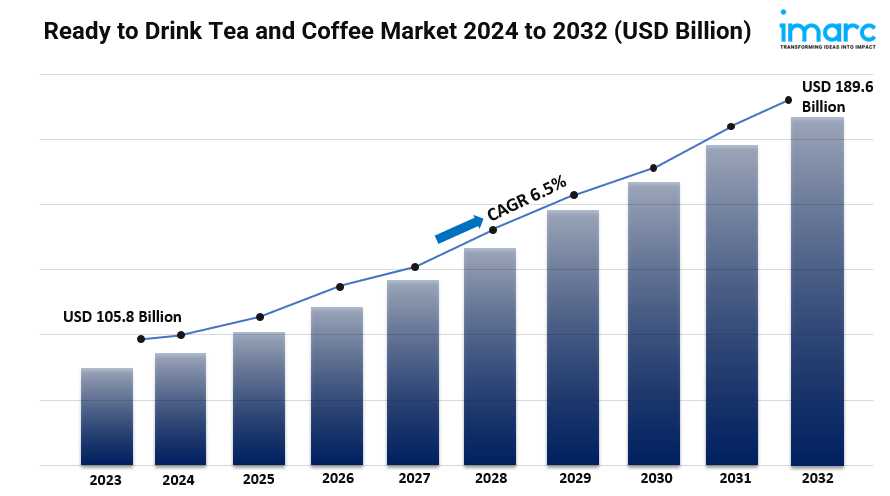

- The global ready-to-drink tea and coffee market size reached USD 105.8 Billion in 2023.

- The market is expected to reach USD 189.6 Billion by 2032, exhibiting a growth rate (CAGR) of 6.5% during 2024-2032.

- RTD tea leads the market, accounting for the largest ready-to-drink tea and coffee market share.

- On the basis of additives, the market is segmented into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others.

- PET bottle accounts for the majority of the market share in the packaging segment due to their affordability, strong, and lightweight, which makes them perfect for RTD drinks.

- Based on the price segment, the market is classified into premium, regular, popular priced, fountain, and super premium.

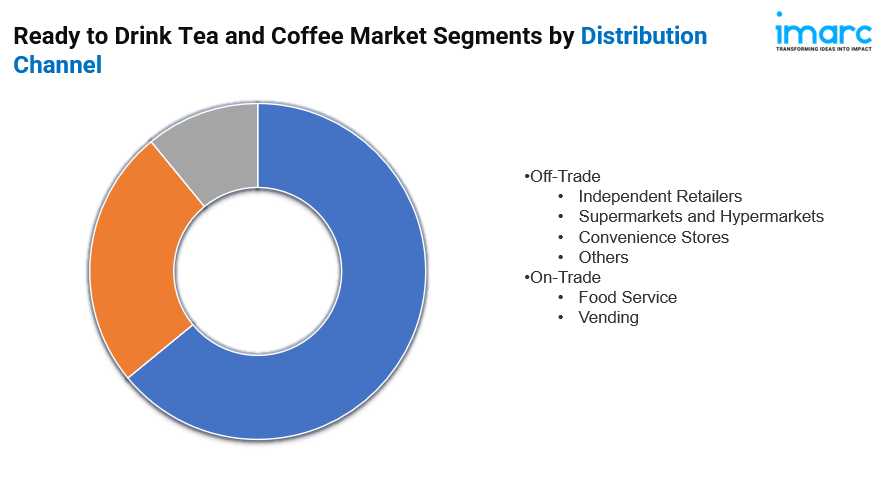

- Off-trade channel remain a dominant segment in the market because they are widely accessible and simple for customers to obtain.

- Increasing urbanization leads to higher demand for convenient ready-to-drink (RTD) tea and coffee options as city dwellers seek quick and easy beverage solutions amidst their busy lifestyles.

- The growth of retail channels, including convenience stores and online platforms, enhances the accessibility and availability of RTD tea and coffee products to a broader consumer base.

Industry Trends and Drivers:

- Increasing consumer demand for convenience:

The fast-paced modern lifestyle has significantly contributed to the rising demand for convenience-oriented products. RTD tea and coffee cater to this need by providing a quick and accessible option for consumers who are on the go. The convenience of having a pre-packaged beverage that requires no preparation aligns well with busy schedules, making RTD drinks an attractive choice for consumers seeking efficiency without compromising on quality. Additionally, the availability of RTD beverages in various sizes and packaging formats, such as single-serve bottles and cans, enhances their portability and appeal. This trend is particularly pronounced among young professionals, students, and busy families who value the ease and speed of consumption offered by RTD tea and coffee impelling the market growth.

- Rising health consciousness:

There is a growing trend towards health and wellness, influencing consumer choices across various food and beverage categories, including RTD tea and coffee. Health-conscious consumers are increasingly seeking beverages that offer functional benefits beyond just taste and caffeine content. This has led to a surge in the popularity of RTD teas and coffees that are marketed as having health benefits, such as antioxidant-rich green teas, low-calorie options, and beverages fortified with vitamins or adaptogens. The inclusion of natural and organic ingredients in RTD beverages also caters to consumers' preference for healthier, cleaner-label products. As the focus on health and well-being continues to rise, the RTD market is experiencing growth driven by these health-oriented product innovations.

- Growth of innovative product offerings:

Innovation plays a crucial role in driving the RTD tea and coffee market, with manufacturers continuously introducing new flavors, formulations, and functional ingredients to attract consumers. The expansion of product lines to include exotic and unique flavors, such as matcha, chai, and cold brew varieties, caters to evolving consumer tastes and preferences. Additionally, the introduction of RTD beverages with functional benefits, such as energy-boosting ingredients, probiotic cultures, and enhanced hydration features, enhances market appeal. The rise of premium and specialty RTD options, including artisanal blends and single-origin coffees, reflects the increasing demand for high-quality and diverse beverage choices.

Request for a sample copy of this report: https://www.imarcgroup.com/ready-to-drink-tea-coffee-market/requestsample

Ready to Drink Tea and Coffee Market Report Segmentation:

Breakup By Product:

- RTD Tea

- Black Tea

- Fruit Herbal Based Tea

- Oolong Tea

- Green Tea

- RTD Coffee

- Ginseng

- Vitamin B

- Taurine

- Guarana

- Yerba Mate

- Acai Berry

RTD tea dominates the market due to its wide variety of flavors and perceived health benefits compared to RTD coffee.

Breakup By Additives:

- Flavors

- Artificial Sweeteners

- Acidulants

- Nutraceuticals

- Condoms

- Others

On the basis of additives, the market is segmented into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others.

Breakup By Packaging:

- Glass Bottle

- Canned

- PET Bottle

- Aseptic

- Others

PET bottle accounts for the majority of shares because they are favored for their lightweight, durability, and cost-effectiveness, making them ideal for RTD beverages.

Breakup By Price Segment:

- Premium

- Regular

- Popular Priced

- Fountain

- Super Premium

Based on the price segment, the market is classified into premium, regular, popular priced, fountain, and super premium.

Breakup By Distribution Channel:

- Off Trade

- Independent Retailers

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

- On-Trade

- Foodservice

- Vending

Off-trade channel holds the majority of shares due to their widespread availability and ease of access for consumers.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific represents the largest segment due to its strong tea culture and high consumption rates of RTD beverages in countries like China and Japan.

Top Ready-to-Drink Tea and Coffee Market Leaders:

The ready-to-drink tea and coffee market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Asahi Breweries

- Dr Pepper Snapple Group

- Starbucks

- Pepsico

- The Coca-Cola Company

- Ajinomoto General Foods Inc.

- Ting Hsin International Group

- Uni-President Enterprises Corporation

- Nestlé

- Dunkin' Brands

- Ferolito Vultaggio Sons

- Keurig Dr Pepper

- Hangzhou Wahaha Group

- Chilsung Fights

- Monster Beverage

- San Benedetto Mineral Water

- Kirin Holdings Co.

- Unilever

- Arizona Beverage Co.

- Suntory

Browse full report with TOC List of Figures: https://www.imarcgroup.com/ready-to-drink-tea-coffee-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most changemakers to create a lasting ambitious impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145